[ad_1]

Around the time of the intervention in September, the authorities came when the USD/JPY pair approached the 145 level.

- The Japanese yen quickly gave up the gains of the recent market intervention by Japan.

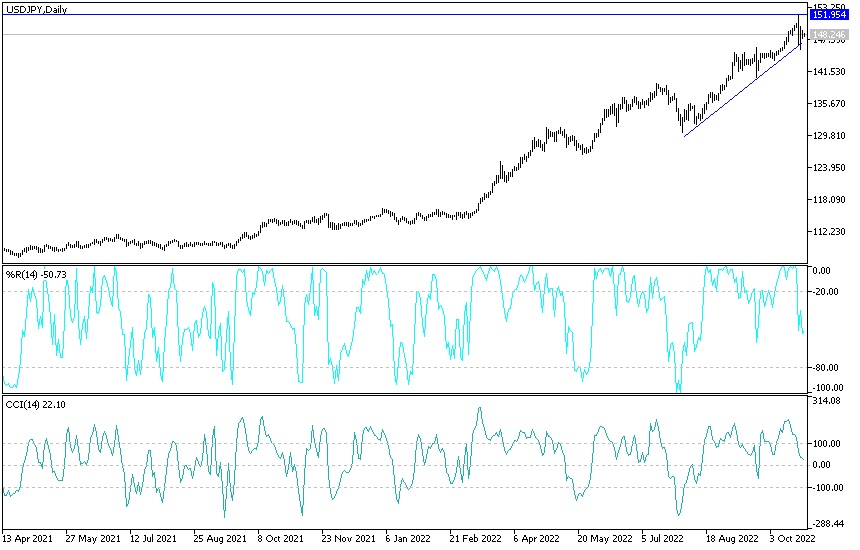

- The USD/JPY pair returned above the 149.00 resistance, near the currency pair’s 32-year high.

- As I mentioned before, the clear contrast between the strict policy of the US Federal Reserve and the Bank of Japan, which has so far adopted negative interest rates, will remain a catalyst for the bulls to launch higher.

Japan has reportedly spent billions propping up the faltering yen. However, unless inflation-adjusted state revenue improves, authorities will find their efforts akin to putting band-aid on a severed artery. First, the facts — or at least what the media thinks actually happened near the end of trading last week. USD/JPY, which was close to 152, made a sudden drop. One that would hit nearly 146 in just two hours, a slowing pace one wouldn’t normally see in the absence of important news.

Financial broker Central Tanshi Co. estimates that Japanese authorities have spent as much as 5.5 trillion yen (about $37 billion) to prop up the yen. It is not clear whether the reported intrusions actually occurred, as US Treasury Secretary Janet Yellen said she had no information about such an incident. But there was no denying the magnitude of the volatility that shook the markets. This is in contrast to what happened in September, when the Japanese authorities confirmed their intervention. Unlike Friday, the previous case occurred very early on the world clock when Tokyo was still high and likely to trade.

Around the time of the intervention in September, the authorities came when the USD/JPY pair approached the 145 level. While their actions boosted the yen at the time, the point was that by the time of the next action reported last week, the yen had already fallen more than 4%. At the heart of the yen’s predicament is the BoJ’s dominance of the yield curve and what that means for the nominal and real spreads. For example, inflation-adjusted spreads have moved nearly 400 basis points in favor of the dollar at the five-year point of the curve this year — a massive swing by any account. This is just a reflection of the discrepancy between what the Fed is doing and the BoJ’s inaction (which is entirely justified given Japan’s frustrating efforts to ignite long-term inflation).

Regardless of the legitimacy of the Bank of Japan’s position, the task of traders is to price currencies, and they do so with confidence. That is why the efforts of the Japanese authorities are such a futile task. The effort to roll down a huge boulder is sometimes not worth it. No matter how dangerous the moves in the yen may be, the authorities may have to put up with them for now. The bright side is that when the tide turns, as it inevitably will when spreads stop deteriorating, the Japanese authorities will find the yen to be too resilient to recover. The yen’s current weak levels point to a point in its journey, not its final destination.

USD/JPY Forecast

There is no change in my technical view of the price performance of the USD/JPY currency pair, as the general trend is still bullish, and the 150.00 psychological resistance is broken. However, with the last intervention, the pair’s record gains will remain a target for selling because it is expected with a Japanese intervention to stop the collapse. The pair’s strength factors mentioned above will keep the bulls in control for a while, and the pair may remain so until the release of the US economic data package as well as the hints of the Bank of Japan this week.

On the downside, continued selling may push the currency pair towards the 147.20 and 146.00 support levels, respectively.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]

Source link