[ad_1]

Bond Market Highlights:

- Bond market looks to have capitulated and on the rebound for the foreseeable future

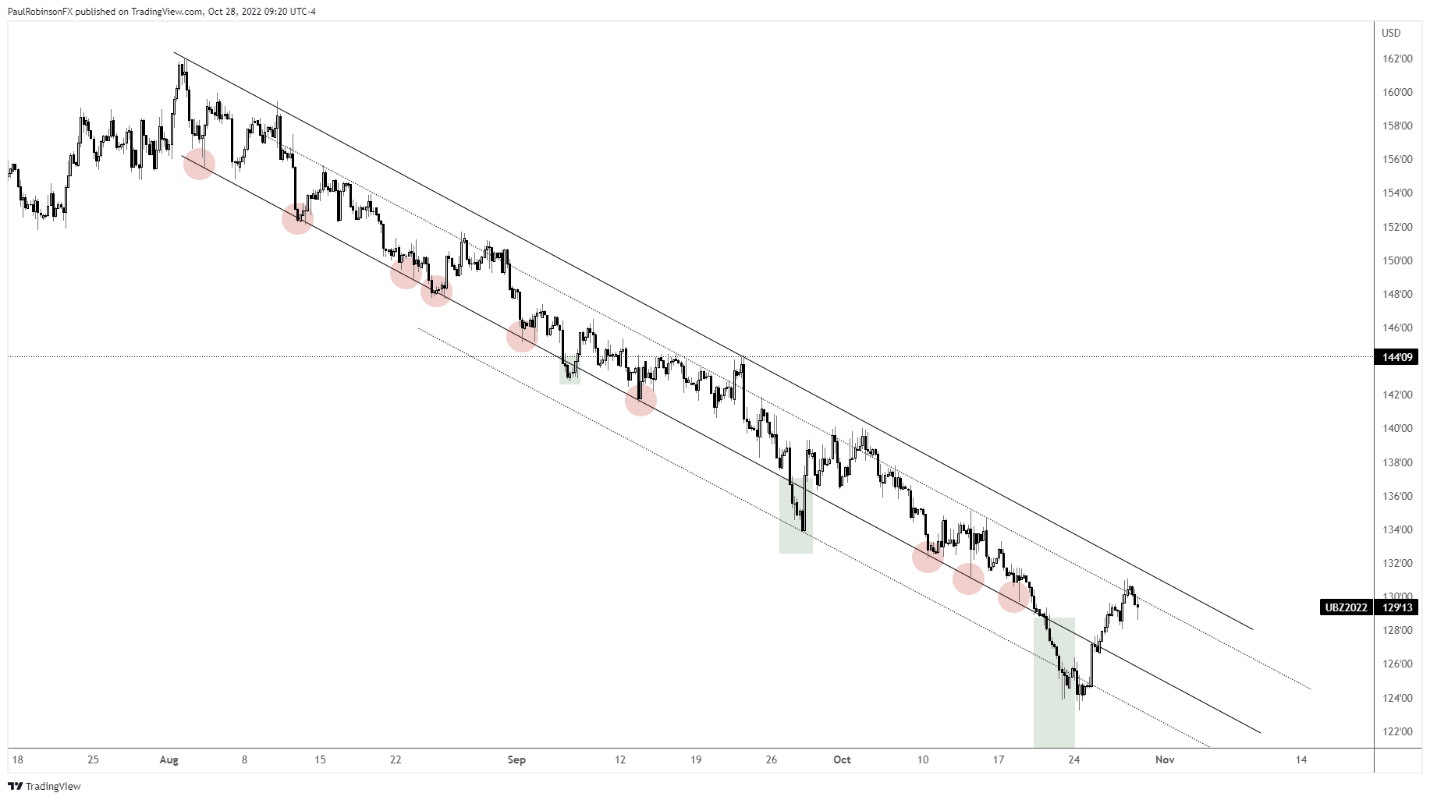

- Channel structure in place on the Ultra 30-yr acts as a guide

Recommended by Paul Robinson

Get Your Free USD Forecast

A week ago today I looked at the bond market and wrote that it looked like a bottom may be near based on the capitulation we were seeing. Selling over the week prior was one of the heaviest week-long stretches we had seen since the bond market topped during the nearly days of the pandemic.

On Monday, bonds hit a low and have bounced hard thus far. After going “off the rails” with the channel structure clearly seen on the 4-hr chart, the 30-yr Ultra bond is well inside and on its way to the other parallel.

This may very well act as a stiff level of resistance upon the first testing of this line, but in time it is anticipated it will break. A pullback could offer up an opportunity for would-be dip-buyers to enter long, with a break out of the channel as confirmation that indeed a low was forged this week.

More conservative traders may even look for the structure to get broken, then look to a retracement following. In any event, so far so good for the bond market as we head towards the final stretch of the year.

Even if you don’t trade bonds, a bullish outlook is likely to be a boon for stocks and headwind for the dollar. This dynamic may loosen a bit as time goes on, but for now the three are very much connected as correlations remain strong. This is something to keep in mind while navigating other markets.

Recommended by Paul Robinson

Futures for Beginners

30-yr Ultra Bonds (UB1!) 4-hr Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link