[ad_1]

Investors are still looking for more clues on how the Federal Reserve will raise interest rates to tame rising inflation ahead of its next meeting later this month.

The Dow Jones Industrial Average rose in its recent trading at the intraday levels, to achieve sharp gains in its last sessions. It went up by 1.40%, to gain about 435.98 points, to settle at the end of trading at the level of 31,581.29, after declining in Tuesday’s trading by -0.55%.

Current volatility is making great stock trading opportunities – don’t miss out!

Investors are still looking for more clues on how the Federal Reserve will raise interest rates to tame rising inflation ahead of its next meeting later this month. As investors shrugged off hawkish comments by Federal Reserve officials earlier on Wednesday, Cleveland Fed President Loretta Meester said the high cost of US accommodation rents had not yet been fully filtered through inflation measures, suggesting that inflation has continues to rise further.

While the focus will be on Powell’s speech on Thursday and US consumer price data next week for clues on the direction of monetary policy.

The Federal Reserve’s “Beige Book,” a periodic glimpse into the health of the US economy, indicated that price pressures are expected to continue until at least the end of the year.

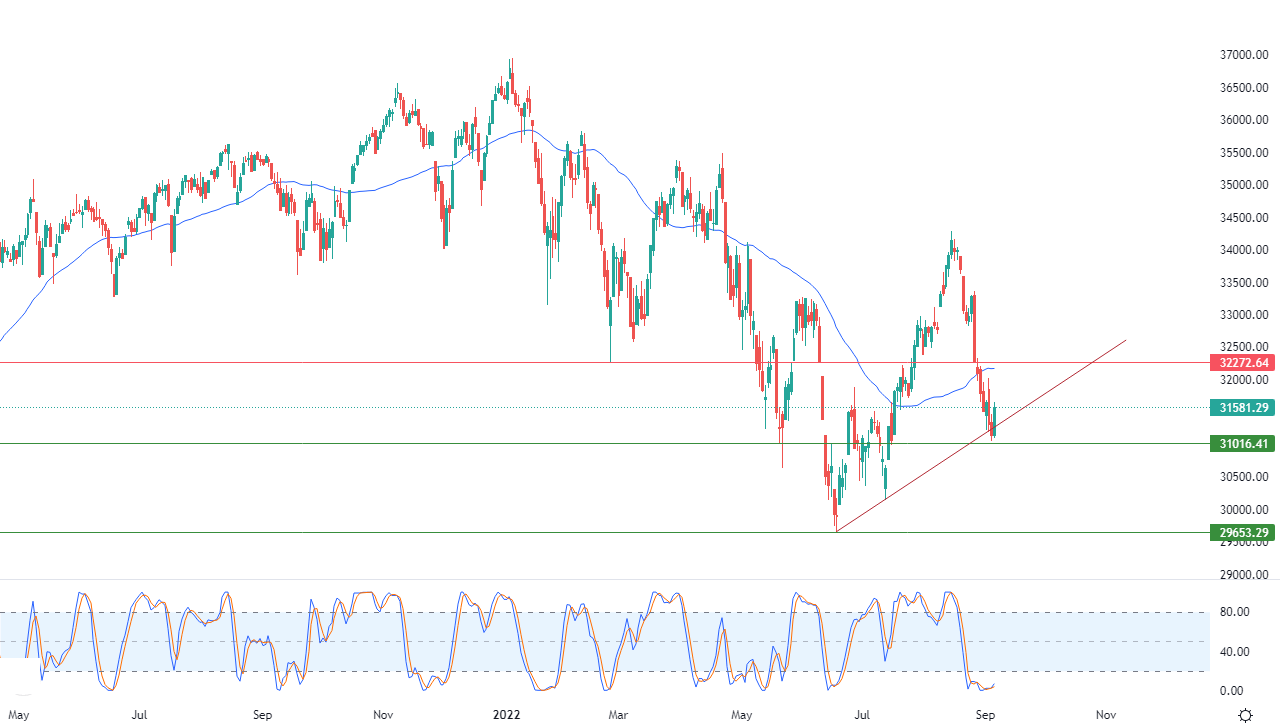

Dow Jones Technical Analysis

- Technically, the index found some support as a result of relying on a minor and corrective slope in the short term, as shown in the attached chart for a period of time (daily).

- This happened after approaching the base of the main 31,000 support level, so the index is trying with this rise to compensate for part of what it incurred from previous losses.

- At the same time, some people are trying to exaggerate their oversold trend with the RSIs, after they reached oversold areas, in an exaggerated way compared to the movement of the index.

- This suggests that a positive divergence is beginning to appear in it, especially with the beginning of a positive crossover.

But in front of that, the dominant trend remains the bearish trend over the short term, with the continuation of negative pressure for its trading below the simple moving average for the previous 50 days.

Therefore, our expectations suggest a return to the index’s decline during its upcoming trading, if the 32,272.65 resistance remains intact, to target the main 31,000 support level in preparation to break it.

Ready to trade the Dow Jones 30 daily analysis and prediction? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.

[ad_2]

Source link