[ad_1]

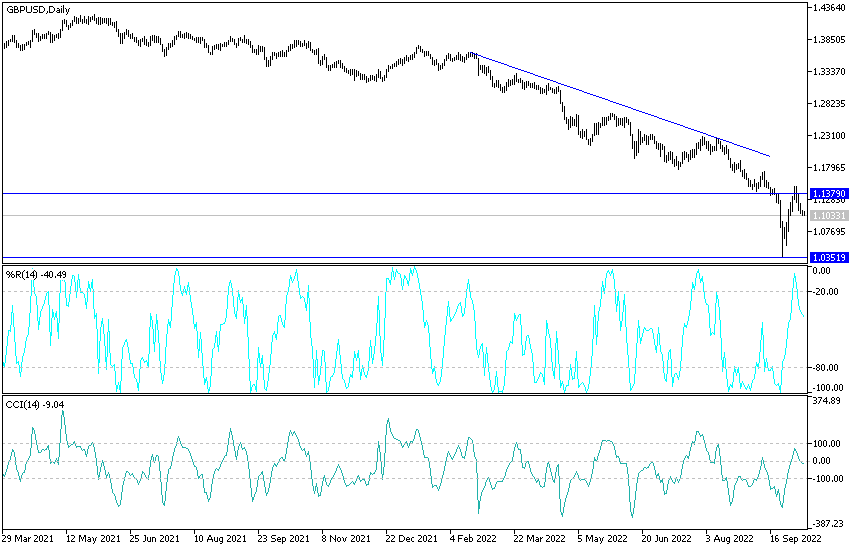

GBP/USD charted a line below its losses in late September and could now look to consolidate its grip on the 1.10 support level recently recovered this week. The pair will be sensitive all the way to the renminbi’s path and a string of important economic data due out From Britain and the United States.

- The British pound rose significantly against several currencies during the first half of last week, which caused the GBP/USD pair to recover to around the 1.15 level on Tuesday.

- It then eased lower as the US dollar returned before the weekend.

- Amid the dollar’s momentum from the US jobs numbers, the currency pair fell towards the 1.1020 support level at the beginning of this week’s trading.

Prior to that, the dollar was broadly sold early last week but was bought ahead of the weekend with demand seemingly encouraged by better-than-expected US data including the Institute for Supply Management Services PMI and an irregular US jobs report.

Commenting on this, Jonathan Millar, chief US economist at Barclays said, “We continue to see too little in the data flow that would seriously undermine the FOMC’s intention to continue the steep gains in November (+75 basis points) and December (+50 basis points). )”. “In fact, with communications consistently indicating a preference for participants for a 75 basis point increase in November, we only see a remote possibility that even an unexpectedly weak CPI print this week will alter those plans,” he added. .

The recent data has continued to highlight the labor market and the US economy in general in a resilient light while doing nothing to deter Fed policy makers from the tighter interest rate stance adopted in September, which was a major source of support for the US dollar. during recent weeks.

These were also headwinds for the Pound and could limit its ability to recover further in the coming days if this week’s data including Thursday’s release of inflation figures for September prove the Bank of its increasingly aggressive efforts to bring down inflation in the US. Commenting on this, Joseph Caporso, Head of International Economics at the Commonwealth Bank of Australia said: “We expect core CPI in the US to exceed consensus expectations once again. Continued high inflation in the US will encourage FOMC members to continue rising aggressively and support further gains in the US dollar.”

The analyst added, “GBP/USD could weaken further this week for two reasons. First, we expect the USD to rise as US inflation could reinforce that the FOMC will not focus on raising interest rates soon. Second, domestic data will reinforce that the UK economy is slowing.”

Thursday’s US inflation numbers are the highlight of the US calendar this week, but Wednesday’s meeting minutes from the Federal Reserve’s September meeting and Friday’s release of US retail sales numbers for September will be closely scrutinized by the market as well. All of these public appearances are permeated by many Fed officials. US economic data will be important in determining market appetite for the dollar and sterling, although the renminbi’s trajectory could also have an important impact on many currencies as Chinese financial markets reopen after the Golden Week holiday. This is partly due to reports that government banks have been tasked with stepping in to prop up the renminbi against the dollar ahead of the Golden Week holiday and given that a very important political event is coming up on the local calendar on October 16th.

To the extent that there is any continuing preference in Beijing to ensure stability in the renminbi during the run-up to the party congress, any intervention to that end is likely to be very supportive of other currencies as well including the pound sterling, which has a strong positive correlation with the renminbi. However, the Pound will also have to navigate a schedule packed with domestic event risks including several speeches from Bank of England (BoE) Monetary Policy Committee members as well as the release of August employment and GDP figures.

GBP/USD forecast today:

The current bears control over the performance of the GBP/USD currency pair, it will get stronger once it breaks below the 1.1000 support price, which may move the technical indicators at the same time towards oversold levels. The next support will be 1.0910. Performance on the daily chart the break of the resistance 1.1380 will be important for the bulls to move higher again.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]

Source link