[ad_1]

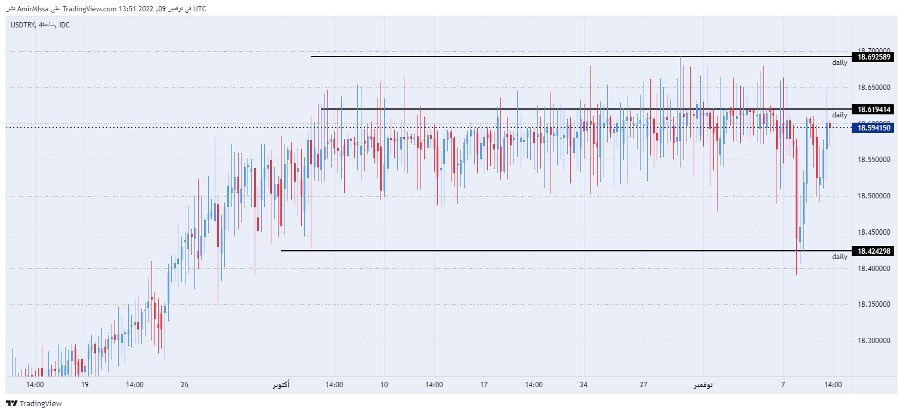

On the technical level, the Turkish lira’s trading settled within a narrow range that has been going on for several weeks, to continue stable for more than a month and a half, amid recording slight movements within the rectangle range shown through the attached chart.

Advertisement

Today’s recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Entering a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The Turkish lira maintained its stability against the US dollar, as the lira did not benefit from the strong dollar’s decline that was recorded over the course of this week and the end of last week. Republicans’ progress at the expense of the Democratic Party is pressuring the markets, as it may contribute to obstructing Biden’s legislative agenda. On the other hand, the poor performance of the Turkish economy continued in light of data showing a rise in the official inflation rate to 83% against the benchmark interest rate, which was reduced during the past month by 150 basis points to 10.5%. The Turkish lira (TRY) fell by 29% against the dollar this year, after losing 44% last year.

TRY/USD Technical Analysis

On the technical level, the Turkish lira’s trading settled within a narrow range that has been going on for several weeks, to continue stable for more than a month and a half, amid recording slight movements within the rectangle range shown through the attached chart. The pair is trading the highest levels of support, which are concentrated at levels of 18.42 and 18.40, respectively.

On the other hand, the lira is trading below the psychological resistance levels at the correct number 19.00. The pair continued trading above the 50, 100 and 200 moving averages on the daily time frame, while the price is trading between these averages on the four-hour time frame as well as on the 50-minute time frame, in an indication of the divergence that the pair is recording at the moment. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free currency signals? Here are the best Forex brokers to choose from.

Ready to trade our free currency signals? Here are the best Forex brokers to choose from.

[ad_2]

Source link