[ad_1]

The Mexican peso (MXN) has been one of the few currencies to appreciate against the US dollar (USD) this year as the country’s central bank, the Bank of Mexico (Banxico), has taken hawkish actions to keep inflation at bay.

Banxico’s aggressive stance has also benefited Mexico’s national currency in appreciating against the euro (EUR). The EUR/MXN forex pair has declined over 19% year-to-date (YTD), indicating rising strength in the peso.

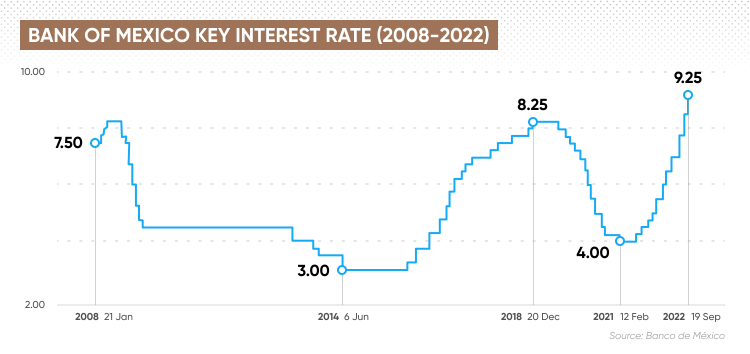

On 29 September, Banxico raised its benchmark interest rate by 75 basis points (bps) to 9.25% – the highest level that overnight daily rates have reached in the Central American country since the institution was created.

This was the eleventh consecutive increase made by the central bank and the third 75bps hike since the institution started pivoting toward a restrictive policy.

The measure catalysed an uptick in the value of the Mexican peso against the US dollar as market participants appear to be favouring a bullish short-term USD/MXN forecast if Banxico continues to increase rates to prevent inflation from spiralling out of control.

In this article, we take a look at the recent drivers of the value of the USD/MXN and EUR/MXN forex trading pairs for a better understanding of analysts’ US dollar to Mexican peso forecasts for 2022 and beyond, and the relationship between the euro and MXN.

What is USD/MXN?

The USD/MXN trading pair showcases how many Mexican pesos the market is willing to accept at any given point in exchange for one US dollar. As of this morning, the value of the USD/MXN pair is standing at 19.96 pesos.

The Mexican economy is highly dependent on the United States – roughly 80% of the country’s exports are destined for export to its neighbouring country. Moreover, millions of Mexicans living in the US typically send money to relatives in their home country. Estimates indicate that Mexican nationals in the US sent around $35bn to their families in Mexico in 2018.

Mexico renewed its free-trade agreement with the United States and Canada in 2020. This agreement allows the country’s exports to pay lower tariffs, making its products cheaper to sell on US soil.

The value of the USD/MXN rate is, therefore, highly influenced by the relationship between the two countries. In addition, measures adopted by Banxico influence the exchange rate of the Mexican peso against other currencies.

What is your sentiment on USD/MXN?

Vote to see Traders sentiment!

USD/MXN price history: how has the Mexican peso performed recently?

The Mexican peso is one of the few currencies that has performed positively against the US dollar so far this year.

Since the year started, the value of the USD/MXN pair has declined 2.7%, indicating that Mexico’s official currency has appreciated against the greenback. This is the case as fewer pesos are needed to purchase one US dollar. The Brazilian real also appreciated by 6.8% against the dollar during that same period.

The US Federal Reserve (Fed) has adopted hawkish measures to prevent inflation from spinning out of control. The Fed has raised its benchmark interest rate to a range between 3% and 3.25%, “increasing the price of money” and making access to credit more expensive.

This has resulted in an increase in the value of the US dollar against currencies of countries that have not adopted similar contractionary measures.

The Mexican peso is performing positively this year as the country’s central bank has reacted by hiking interest rates on multiple occasions to contain inflation

On 28 September, the day Banxico announced its latest 75bps interest rate hike, the value of the USD/MXN pair decreased by 1.3% – this means that the peso strengthened against the US dollar.

Since then, the value of the USD/MXN trading pair has declined from MXN 20.37 to MXN 19.94 – a 2.1% drop in roughly 12 days.

The peso has also gained ground against the euro. The energy crisis prompted by Russia’s invasion of Ukraine has weakened the continent’s economy as inflation has prompted the European Central Bank (ECB) to adopt hawkish measures.

So far this year, the peso has advanced 16.7% against the euro. As 11 October 2022, the value of the EUR/MXN trading pair stands at MXN 19.42.

USD/MXN predictions: latest news and relevant price drivers to consider

If the value of the Mexican peso rises against the greenback, the country’s exports will become more expensive, and vice versa. Here’s an example of how that works.

If Mexican product A has a price of MXN 100 and the USD/MXN exchange rate stands at 20, the price of the product in USD will be $5. If the exchange rate declines to 19, the price will rise to $5.26. Hence, a stronger peso is typically not good news for exporters, whose products may struggle to compete.

US exports have a significant impact on the country’s economic growth. A stronger peso is considered to be a negative factor in the short run. It could prompt the Banxico to adjust its benchmark interest rate to favour a cheaper peso in the long run, which could provide a boost to the country’s exports.

Experts have cited that Banxico needs to maintain a high enough differential between its rate and those of the Federal Reserve to make its domestic currency attractive for investors and businesses.

Inflation is the most relevant factor prompting the central bank to raise rates. Banxico’s estimates indicate that inflation could start to decelerate in the first quarter of 2023 and be around half by year’s end, closing out the year at an inflation average of 4%.

If that happens, the bank may not have the same incentive to keep raising rates. However, if the Fed’s actions do not result in a drop in the US inflation rate, it could continue to raise rates, forcing Banxico to act. In that case, the Bank of Mexico could have to follow the Fed’s pace to prevent the peso from getting too expensive, as that would hurt the country’s exports.In a recent overview of the USD/MXN currency pair, Capital.com FX analyst Piero Cingari opined that the MXN is looking increasingly vulnerable against the USD:

“The Mexican peso has been perfectly shielded by the carry trade, as the Banxico-Fed policy rate differential has hovered between 5.5 and 6% since March 2022.”

“However, the strengthening of the MXN may be nearing its peak. Given Mexico’s strong economic reliance on the United States, a slowdown in the latter would severely harm the former.”

USD/MXN forecasts: 2022-2025

Estimates from Wallet Investor, a third-party forecasting service, are favouring a neutral short-term USD/MXN forecast. The algorithm is predicting that the Mexican peso will stay in a range between MXN 19.67 and MXN 19.90 in the following 14 days.

These are the service’s predictions for the mid and long-term:

USD/MXN forecast for 2022: MXN 20.22

USD/MXN forecast for 2025: MXN 20.60

USD/MXN forecast for 2030: not provided

The baseline short-term USD/MXN forecast from Gov.Capital is bullish. The service estimated that the Mexican peso could surge near the 21 level within the next 14 days, based on an analysis of the forex pair’s price trend.

These are the service’s USD/MXN predictions for the mid and long term:

USD/MXN forecast for 2022: MXN 19.97

USD/MXN forecast for 2025: MXN 84.55

USD/MXN forecast for 2030: not provided

None of the estimates or comments shared in this article should be considered a recommendation to buy or sell the USD/MXN pair.

Investors and traders are encouraged to perform their own due diligence before making any investment decision, looking at the latest news, a wide range of analyst commentary, technical and fundamental analysis.

FAQs

Why has USD/MXN been dropping?

The value of the USD/MXN trading pair has been dropping since late September as Mexico’s central bank has raised its benchmark interest rate aggressively to keep inflation in check.

Will USD/MXN go up or down?

According to estimates from third-party forecasting services, the value of the USD/MXN pair is expected to rise in the next one to three years. These forecasts have been drafted on an analysis of the forex pair’s historical price trend.

Remember that past results do not guarantee future performance, and that analysts and algorithm-based forecast services can and do get their projections wrong. Always do your own research before making an investment decision. And never invest or trade more than you can afford to lose.

When is the best time to trade USD/MXN?

There is no explicitly “good” or “bad” time to trade USD/MXN, as the forex market is available 24 hours a day. The decision to operate with this pair or to take a long or short position on the instrument should only be made after analysing its fundamentals and price action.

However, some of the best times to trade this instrument are between 13.00 to 17.00 GMT. This is the time when both the London and New York markets are open, meaning USD/MXN spreads are normally tightest during this time due to a lot of market activity. There will also be times during the day when this currency pair experiences higher volumes – typically around major market announcements.

Is USD/MXN a buy, sell, or hold?

Third-party forecasting services cited in this article, such as Wallet Investor and Gov.Capital, estimate that the value of the USD/MXN trading pair could rise in the mid and long term.

However, this should not be considered a recommendation to invest in USD/MXN, as many factors can affect the pair. It is essential to note that analysts and algorithm-based prediction services can and do get their forecasts wrong.

Past performance is not a guarantee of future results. Always do your own due diligence before making an investment decision. And never invest more than you can afford to lose.

Further reading:

[ad_2]

Source link