[ad_1]

Every four years, cryptocurrency experiences a market bubble driven by the Bitcoin “halving” event. But, what is this event, and why is it important?

People who invest in (and speculate on) cryptocurrencies all base their investment strategy on one event – the Bitcoin Halving cycle (sometimes light-heartedly referred to as “The Halvening“). Bitcoin uses a Proof-of-Work (PoW) cryptocurrency mining protocol to achieve consensus across the network while securing it against attacks and dishonest actors.

This system protects the blockchain’s history from being tampered with by making it physically and economically impractical to do so, but it also incurs huge energy costs. To compensate for energy costs, participants are rewarded with new BTC after each new block is produced. While Bitcoin comes under fire for being an energy hog, much of its energy is provided by green energy crypto mining, as renewable energy is often cheaper and more profitable to draw from.

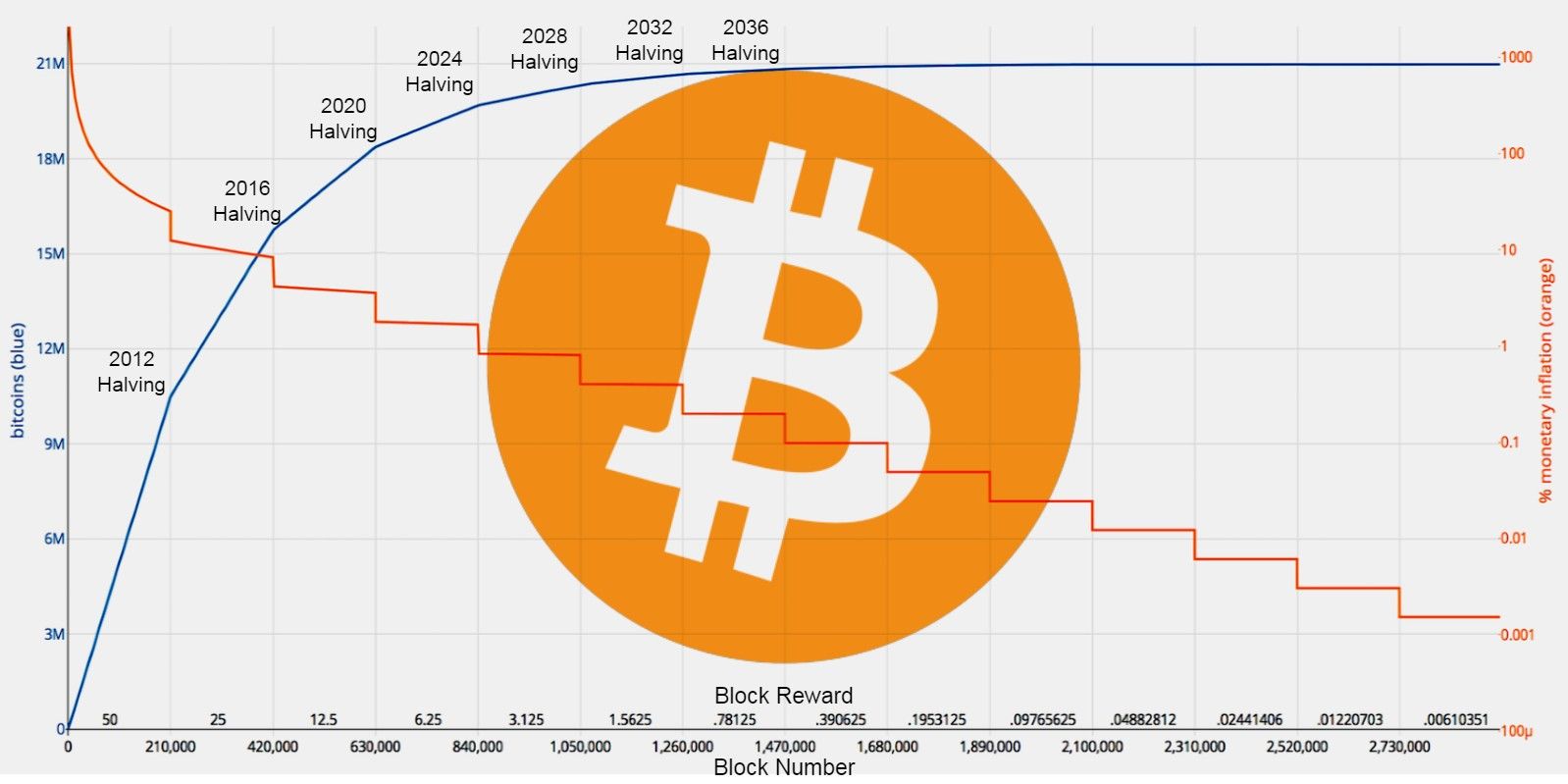

When Satoshi Nakamoto created Bitcoin‘s PoW consensus mechanism, they created a unique monetary policy that would be the opposite of fiat currencies like the US dollar. Whereas dollars can be created infinitely and at-will, BTC can only be created according to its PoW algorithm, and follows a strict inflation program that is unlikely to ever change. As Investopedia explains, the inflation rate of BTC predictably drops 50 percent every four years (specifically, every 210,000 blocks), and this process will continue on until the year 2140, when the last satoshi (the smallest unit of a bitcoin) is mined. What happens after the last bitcoin is mined is still a topic of debate, though the most common theory assumes miners will rely on transaction fees. The next Halving event will occur around March 21, 2024, according to the Bitcoin Halving Clock.

Why Does This Drive Cryptocurrency Market Bubbles?

When a Halving event occurs, it slashes Bitcoin miners’ profits in half as well. When the miners are making fewer bitcoins from mining, they have to either cash out each bitcoin at a higher price or sell bitcoins from their reserves to remain profitable. Meanwhile, the supply of new bitcoins sold by miners also declines as the price increases, allowing investor/trader buy pressure to have a stronger effect on BTC’s price.

So far, every Halving event has sent BTC into a two-year price rally, which trickles down into other cryptocurrencies and causes the speculation bubbles that crypto is renowned and notorious for. Cryptocurrency speculation bubbles mostly arise from crypto traders rolling their BTC profits into smaller ‘altcoins,’ and then selling when hype-driven retail traders pile into the altcoins and pump the prices up. Retail traders are also much more likely to practice the “HODL” strategy rather than take profits, often taking losses as experienced crypto traders choose to take profits instead.

Bitcoin’s monetary policy ensures that its total supply will max out at just under 21 million BTC by the year 2140, which is guaranteed by its four-year Halving cycle. As blockchain technology matures and cryptocurrencies become regulated assets, it is likely speculation on cryptocurrencies will mature as well, and eventually the Bitcoin Halving event will not induce the same market shock that it has for the past 10 years.

Source: Investopedia, Bitcoin Halving Clock

[ad_2]

Source link