[ad_1]

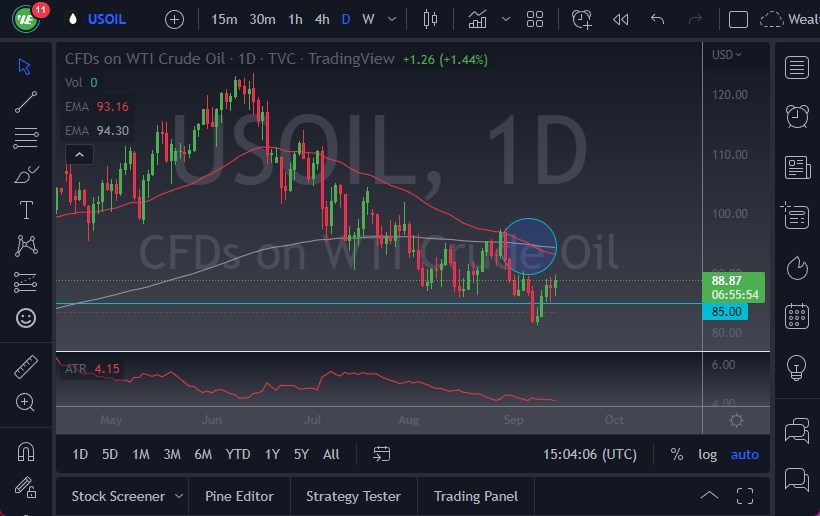

The $90 level just above is offering a little bit of psychological resistance, but I suspect it is probably only a matter of time before the sellers come back regardless.

- The West Texas Intermediate Crude Oil market continues to do very little, as the Wednesday session was another grind fest.

- All things being equal, this is a market that has bounced from an extreme low, so does make a certain amount of sense that we would see a short-term rally.

- The question at this point is whether the market can keep this momentum up, which is questionable considering that there are a lot of concerns about whether there is going to be global demand.

The market recently has seen the so-called “death cross”, when the 50-Day EMA breaks below the 200-Day EMA, signaling a longer-term bearish move could happen. Nonetheless, that’s almost always late, and looking at the most recent selloff over the last couple of months you certainly can see why people think that.

Looking for Signs of Exhaustion

Ultimately, I think you are looking for signs of exhaustion that you can start shorting again because if the world is in fact going into a global recession, it makes very little sense that we would see a lot of demand for crude oil. The $90 level just above is offering a little bit of psychological resistance, but I suspect it is probably only a matter of time before the sellers come back regardless. Even if we break above there, the moving averages will more likely than not have me paying close attention to them as well, as I believe this is a market that has quite a bit of volatility ahead of it. As a rule, volatility is negative for an asset, because there’s a lot of fear in owning it.

If we turn around a break down below the $85 level, it opens a test of the Lowes again, perhaps moving down to the $80 level. It’s worth noting that the Americans have flat-out stated that they are willing to start buying oil again for the Strategic Petroleum Reserve near the $80 level, which is ridiculous considering they just dumped a ton of it into the marketplace. However, it does create a little bit of a floor, so that might be something worth paying attention to in the short term. Longer term, it does cause a bit of a reaction from time to time.

Ready to trade our WTI Crude Oil analysis today? We’ve made a list of the best Forex Oil trading platforms worth trading with.

[ad_2]

Source link